Bankruptcy 7 2010-2024 free printable template

Get, Create, Make and Sign

How to edit chapter 7 bankruptcy forms pdf online

Bankruptcy 7 Form Versions

How to fill out chapter 7 bankruptcy forms

How to fill out chapter 7 bankruptcy forms?

Who needs chapter 7 bankruptcy forms?

Video instructions and help with filling out and completing chapter 7 bankruptcy forms pdf

Instructions and Help about bankruptcy chapter 7 forms pdf

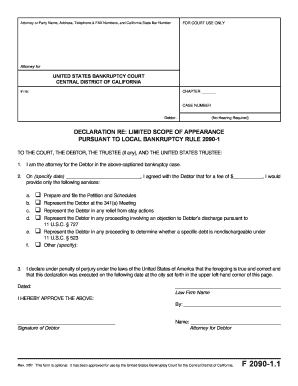

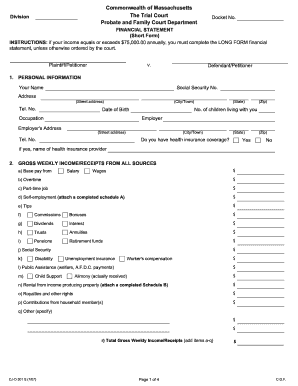

Laws calm legal forms guide what is the statement of financial affairs in a bankruptcy filing a statement of financial affairs represents the official form filled out by a debtor in which the debtor must answer in writing a series of questions concerning their financial affairs the statement of financial affairs found on the beach seven petition for a bankruptcy filing will include questions concerning the debtor sources of income the specifics regarding any and all transfers of property made by the debtor and all information regarding any past lawsuits filed by past creditors the statement of financial affairs helps the Bankruptcy Court determine specific factors regarding an individual bankruptcy case such as the debtors' ability to reorganize or repay their lenders the statement of financial affairs must be filled out in a correct and accurate manner to avoid any penalties or legal situations if you omit any information on this form or supply any incorrect financial information it could negatively affect your bankruptcy filing statement of financial affairs for a chapter 13 filing a chapter 13 bankruptcy is a debt repayment plan in order to file for this type of bankruptcy the individual must be employed, so they can make regular payments to the Bankruptcy Court the payments offered by the filer are then distributed among the individuals various creditors in most instances an individual will be required to file this form of bankruptcy if they can pay at least 25 percent of their debts given their disposable income and savings if the individual is approved for a chapter 13 filing they will make payments for up to 5 years the court will negotiate the filer to pay a portion of the total debts during this time what is on the statement of financial affairs the statement of financial affairs list 25 questions to inquire details regarding your total income for the past three years any amounts you have paid to creditors any lawsuits you have been involved in all property that you own that is in possession of others all expenses you have incurred to file bankruptcy and personal information regarding both you and your spouse to file the statement of affairs you will need all of your financial and legal records from the past three years including your tax returns and any business records / companies you own any part of to watch more of the pleasing make sure to visit laws calm

Fill chapter 7 forms : Try Risk Free

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your chapter 7 bankruptcy forms online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.